Cambodia, Myanmar Develop & Trade

Your trusted partner in ASEAN markets

Why Invest in Cambodia?

Cambodia presents exceptional investment opportunities with strong economic fundamentals, favorable regulations, and competitive advantages over regional markets.

Why Cambodia?

Cambodia offers compelling advantages for foreign investors looking for emerging market opportunities with strong growth potential in Southeast Asia

OPEN ECONOMY:

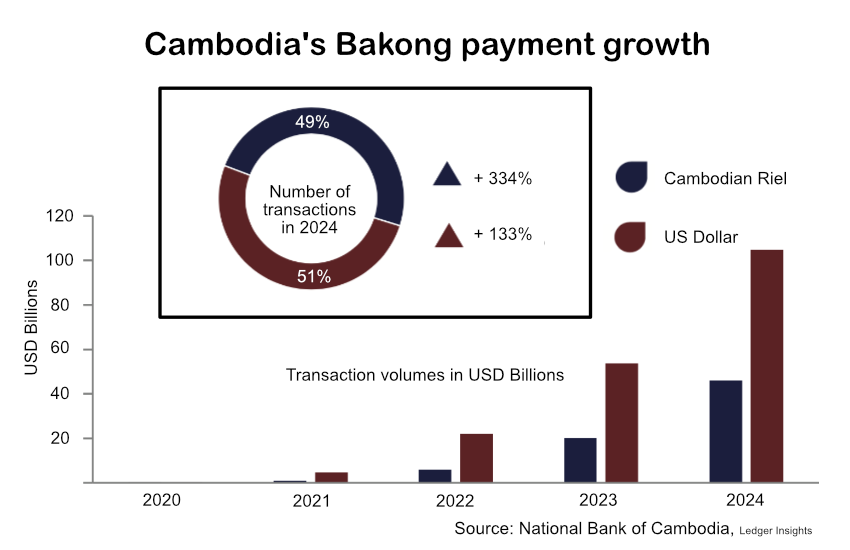

USD-Based Market & Banking Ease

The market is very open to foreign investment, with 100% foreign-owned investment permitted in almost every sector. Documentation is conducted in English, and US dollars are widely used and accepted in business transactions.

The USD-based market reduces currency risk, and foreigners can easily open USD bank accounts with minimal paperwork.

SUSTAINABLE GROWTH:

Booming Real Estate Market & GRR

Cambodia has experienced remarkable economic growth of 5.8% in 2024, and the GDP per capita increased to 2,760 USD. There is a burgeoning middle class and growing expat community, as well as a foreigner-friendly attitude among the local population.

High demand for housing driven by rapid urbanization and foreign investments. Many new developments offer pre-launch discounts with potential for capital gains, and Gross Rental Returns (GRR) enhance overall investment attractiveness.

INVESTMENT CLIMATE:

Tax Advantages & Easy Financing

Investment incentives and Cambodia's tax regime are favorable for foreign investors. The regulatory framework has been broadened and improved recently (for example, the Law on Investment, the new Law on Construction Protection, the new Competition Law, the Law on Taxation, and new property tax exemptions applying to foreign investors).

Tax incentives on capital gains, property transfer taxes, and lower property-related costs. Long-term payment plans are available for foreign buyers.

ACCESS TO GLOBAL MARKET:

Property Ownership & Capital Security

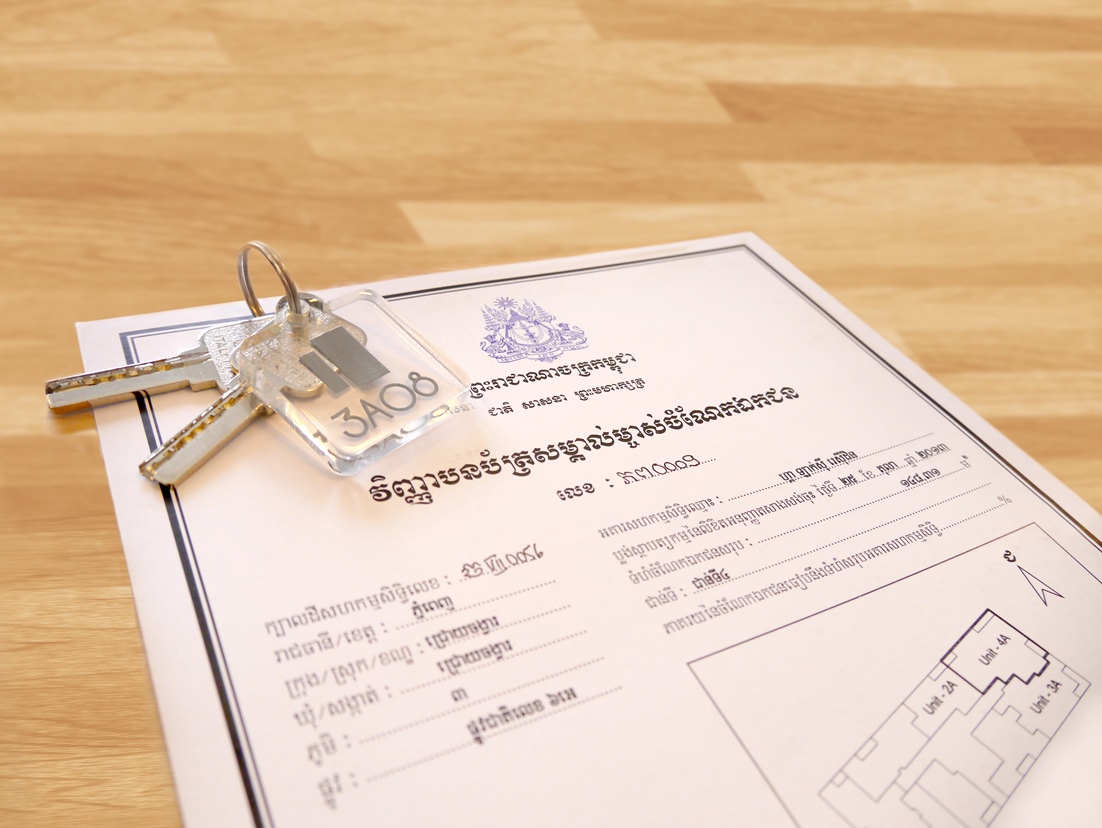

Foreigners can own condos freehold without restrictions, with opportunities for long-term residency and citizenship for freehold land ownership. Cambodia is not listed as a Non-Cooperative Countries and Territories (NCCT) country.

Additionally, Cambodia offers a stable political and economic environment, with a developed financial system aligned with international standards, providing access to neighboring economies and the global market.

2024 Key Highlights

Cambodia's remarkable growth across all sectors demonstrates the country's robust economic expansion and investment potential

Hotel Sector

Exisiting supply reach appoximatively 16,000 rooms an increase of 7% from last year. An additional 3,300 rooms units are planned, 58% of this future supply will be high-end segment.

Population

Based on NiS statement in Q1 2025, Phnom Penh has 2.8 million resident, Foreign Residents and temporary population (+21.7% compared to 2020).

Office Sector

1.1 million NLA in Q4 2024 (+5.7% in one year), with an estimated occupancy of 61.5%.

Service Apartment

The cumulative supply of service apartment is 8,100 units, with a slower growth rate at 2% compared to previous years. Based on planned units, the sector grwoth is forecasted at 22% from 2024 to 2027.

Retail Sector

870 thousand NLA in Q4 2024 (+3% in one year), with an estimated occupancy of 64.5%.

Condominium

Q4 2024 total existing condominium are recorded at 57 thousand units, with 7,720 units completed in 2024, corresponding to 15.6% supply growth rate.

Industry Sector

In 2024, Industry in Phnom Penh covered 705 hectares, with 414 projects, corresponding to an increase of 52% from previous year. In 2025, the expected growth is 8.6% based on World bank estimations.

Landed Housing

The existing supply of landed housing is 95 thousand units, with an annual growth of 8%. 2025 forecast are lower with only 2.3% estimated.

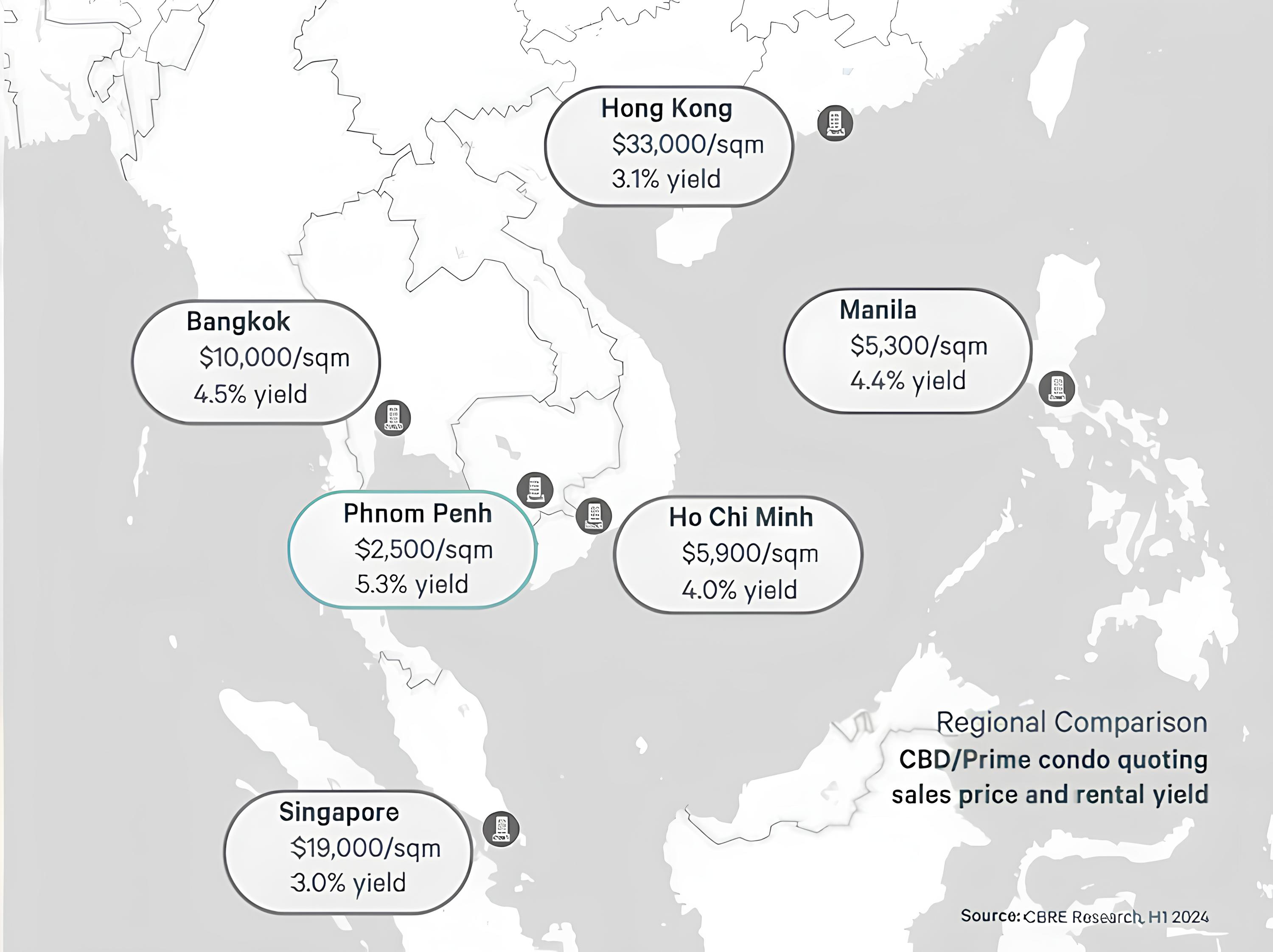

Regional Price Comparison

Cambodia offers extraordinary value with market-leading yields and significantly lower entry prices compared to neighboring Southeast Asian markets

Phnom Penh

Cambodia

Why Phnom Penh Leads the Region

Best investment value with lowest entry price and highest yield in the region. With the perfect combination of affordability and high returns, it represents the most compelling investment opportunity in Southeast Asia.

Compare with Other Regional Markets

Ho Chi Minh

Vietnam

Bangkok

Thailand

Manila

Philippines

Singapore

Singapore

Hong Kong

Hong Kong SAR

Regional Market Overview

Cambodia's strategic location and competitive pricing make it the most attractive investment destination in Southeast Asia